When you get a personal loan your repayments will engage in what’s called loan amortisation. But what does this actually mean? Why is it important to know how much each payment is paying off my interest and principal?

Say goodbye to all that confusion. In this article, we’ll delve into the details of loan amortisation, how it works, and why it can be the superior loan repayment structure.

A recap on personal loans

Before we get into the nitty-gritty of personal loan repayments and amortisation, let’s remind ourselves of what personal loans are.

A personal loan is when you borrow an amount of money that is to be paid back over a fixed term. Personal loans have a fixed interest rate and can be either secured (guaranteed by an asset as security) or unsecured (the opposite – not backed by collateral). They can be used to finance most things, ranging from holidays to buying a new car.

Because a personal loan is a lump sum, lenders do not allow ongoing access to funds like a credit card. However, personal loans tend to have lower interest rates. Personal loans are available through various institutions, including banks, credit unions, peer-to-peer lenders and loan shops.

If you’re interested in learning more about personal loans and credit then check out one of our earlier articles on the difference here.

Okay, where does amortisation come in?

Personal loans are a type of amortising loan. As the borrower, you make the same regular payments throughout the loan term. Your first payment will mainly pay off interest, but the remainder will go towards the loan principal. As a result, the more payments you make throughout the term, the more your principal will be paid off. Towards the end of your loan term, the payments you make will be less towards interest and more towards the principal.

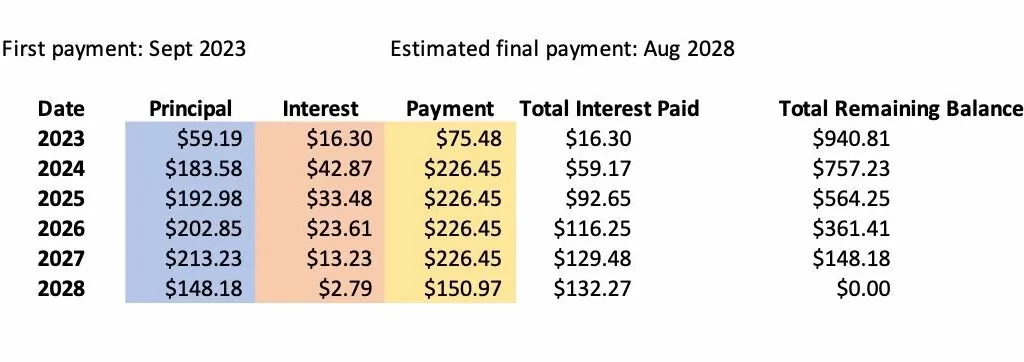

Therefore, amortisation refers to the rate in which we’re paying off the full principal of the loan. A fully amortising loan will be completely paid off at the end of the term. When a lender provides a loan amortisation schedule, it showcases how long repayment will take and how much of each payment is going towards interest and principal. This is important to know as it will demonstrate to you how quickly your loan can be repaid and where exactly your money is going.

You can calculate yourself the amortisation of your loan through online amortisation calculators. Consider the following example of a $1,000 loan with a five-year term and interest rate of 5%:

In contrast, an unamortised loan would be where the payments are lower but you’re only paying off interest. Under this payment structure, the end of the loan term will a higher amount of the principal left (rather than completely paid off). Sometimes this will require the borrower to make a final “balloon payment” to take care of the remaining principal. The large amount of balloon payments can be difficult for borrowers. Personal loans prevent this from happening by ensuring you’re paying off not just interest, but principal as well.

It’s important to note that although personal loans and amortisation dictate the minimum and regular payments, they do not prevent additional and early payments. The faster you decide to pay off your loan, the more you’ll save on total interest over the lifetime of the loan.

If you want to learn more about loan amortisation, you may find this video from Trevor Calton’s Real Estate Finance Academy helpful.

Why can personal loans and amortisation be better than unamortised loans?

Because unamortised loans only pay off the interest on the loan, the regular payments end up being less than the amortising payments of a personal loan. The lower regular payments coupled with a bigger lump sum payment at the end for the principal can work for individuals who know they have a large amount of income coming in the future. Namely, contractors or employees that earn on commission.

Otherwise, unamortised loans can prove quite difficult for the average borrower. Bang for buck, amortising personal loans will prove favourable for most people. Although the regular payments will be higher than for an unamortised loan, the borrower will have confidence that the full amount of the loan is reduced with each payment. Because of this, equity in the asset guaranteed as security will be increasing.

Ultimately, whether an unamortised or amortised loan will be a better fit for you will come down to your own personal circumstances and earnings.

Summary

In summary, in this article we discussed:

- Personal loans and what they can be used for

- How repayment works for personal loans

- How amortisation works and why it can be better than unamortised loans

If you’re interested in learning more details about a personal loan then Pioneer Finance can help. Get in touch with the team we’d be happy to help.